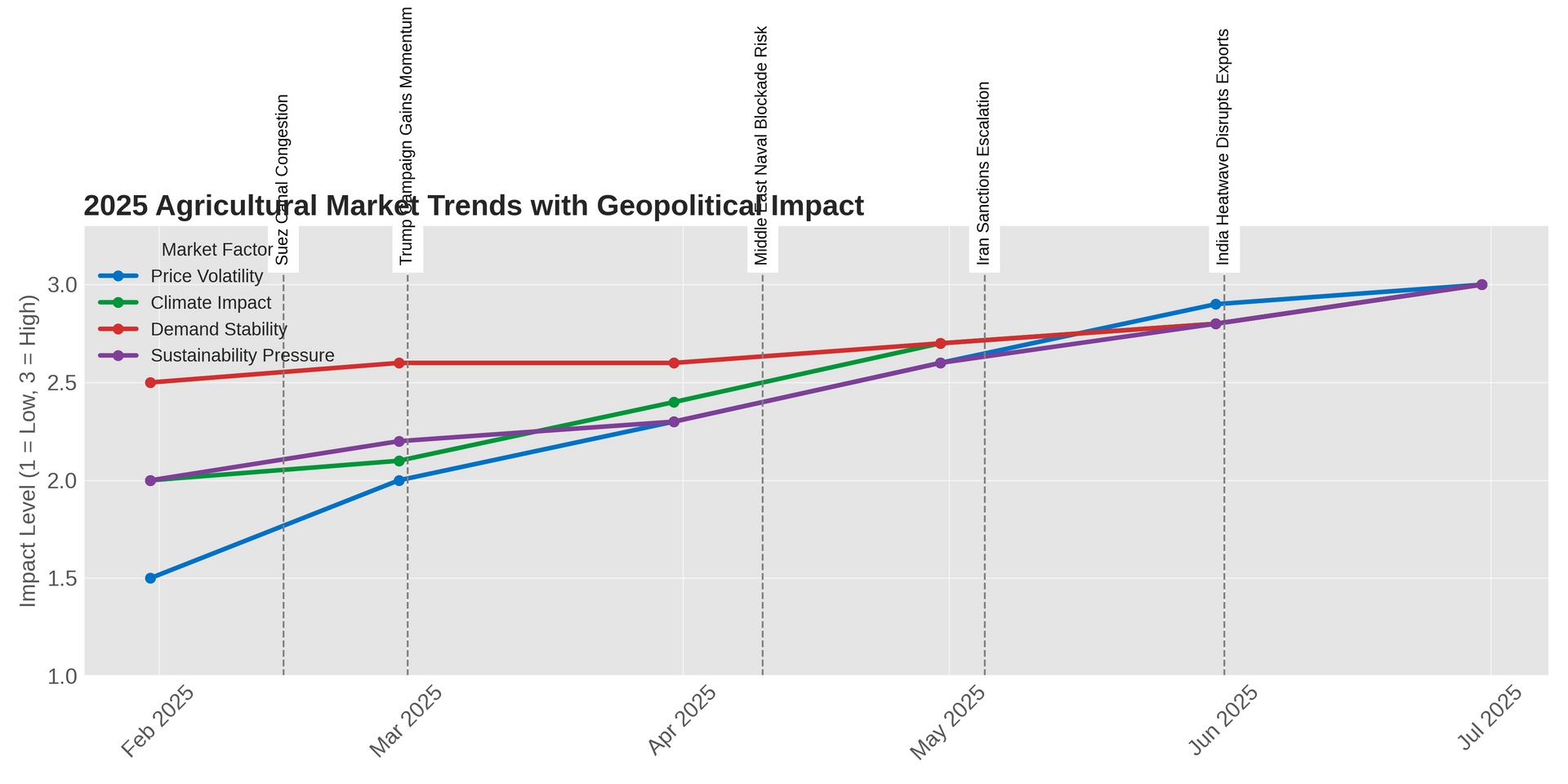

The global agricultural commodity market in 2025 is undergoing significant transformation, shaped by climate disruptions, shifting trade dynamics, and increasing demand for sustainability and traceability. Market volatility has intensified as key staples like wheat, coffee, and cocoa experience price pressure due to weather shocks, logistical bottlenecks, and geopolitical events.

Wheat prices remain sensitive following poor harvests in the Black Sea region and tighter export controls. Cocoa continues its historic rally as West African supply falters, while coffee prices remain elevated due to erratic rainfall patterns in major growing regions like Brazil and Vietnam. Meanwhile, edible oils—including canola, sunflower, and palm—are impacted by droughts, export restrictions, and biofuel policy changes, further tightening global supply.

In contrast, nuts such as cashew and coconut are seeing steady demand, supported by growing consumer markets and improved local processing in West Africa and Southeast Asia. Cotton and orange juice markets also show increased resilience, though climate stress and disease outbreaks are narrowing supply margins.

Amid these shifts, sustainability has moved from an optional feature to a core market driver. Buyers are prioritizing traceable, ethically sourced products, especially in the EU and North America, where regulatory pressure is rising. Supply chains are adapting through digitization—using satellite monitoring, QR tagging, and blockchain tools to verify origin, labor conditions, and environmental impact.

Strategically located trade hubs—in countries like Brazil, Thailand, Côte d’Ivoire, and Egypt—are becoming increasingly important. These regions are not only rich in supply but also serve as gateways to emerging trade corridors in Africa, Asia, and the Middle East, unlocking new efficiencies and market access.

For traders and buyers alike, the message is clear: agility, transparency, and on-the-ground presence are essential. As the market continues to evolve, those who integrate sustainable sourcing practices, local partnerships, and real-time data tools will be best positioned to navigate risks and seize global opportunities.

Agricultural Commodity Market Insights

Current Trends in Nuts, Wheat, and Coffee Markets

12% Increase

Global cashew exports rose by 12% in Q1 2024, driven by higher demand in Asia and Europe.

8.5% Decline

Wheat futures saw an 8.5% drop amid favorable harvest forecasts in major producing regions.

4.3 Million Bags

Coffee production reached 4.3 million bags in Brazil this season, marking a 3% growth year-over-year.

15% Growth

Coconut nut prices increased by 15% due to supply constraints in Southeast Asia and rising global consumption.

Leverage Market Timing

Use historical price patterns and seasonal trends to identify optimal entry and exit points in agricultural commodity markets.

Learn More

Diversify Commodity Portfolio

Balance risk by trading a mix of nuts, grains, and soft commodities to stabilize returns amid market fluctuations.

Explore Strategies

Implement Hedging Techniques

Protect profits by using futures and options contracts to mitigate price volatility in key agricultural products.

Get Insights

Monitor Global Supply Factors

Track weather patterns, geopolitical events, and crop reports to anticipate supply disruptions affecting commodity prices.

Stay Updated

Adopt Algorithmic Trading

Utilize data-driven algorithms to execute trades efficiently and capitalize on short-term market movements.

Discover Tools

Focus on Sustainable Sourcing

Incorporate sustainability criteria into trading decisions to align with evolving market demands and regulatory standards.

Learn How

Integrating sustainability into agricultural supply chains safeguards resources and enhances market resilience.

The Role of Sustainable Supply Chains in Agriculture

Agricultural Commodities Reports & Whitepapers

Trusted Insights, Proven Results

B & O Commodities' market expertise and tailored trading strategies have consistently enhanced our portfolio performance, delivering reliable growth in volatile markets.

Get In Touch for Tailored Market Insights

Reach out to our offices worldwide to discuss detailed reports, market trends, and trading strategies customized to your needs. Our team is ready to support your agricultural commodity ventures with expert guidance and timely information.

Contact Us

We will get back to you as soon as possible.

Please try again later.